September 19, 2023 7 minutes read

Maximizing Profits in Bear Markets using AI Trading

Over the years, artificial intelligence (AI) has revolutionized keen industries such as finance, crypto, education, and health care. Adopting AI-powered automated trading systems has gained significant popularity among retail traders. This can be attributed to the growing interest among traders to learn from the strategies implemented by Wall Street professionals.

AI-powered trading bots offer significant advantages in analyzing vast amounts of market data. They excel at identifying patterns and trends that might not be readily noticeable to human traders. By leveraging this advanced technology, trading bots can make informed decisions and potentially minimize risks while maximizing profits.

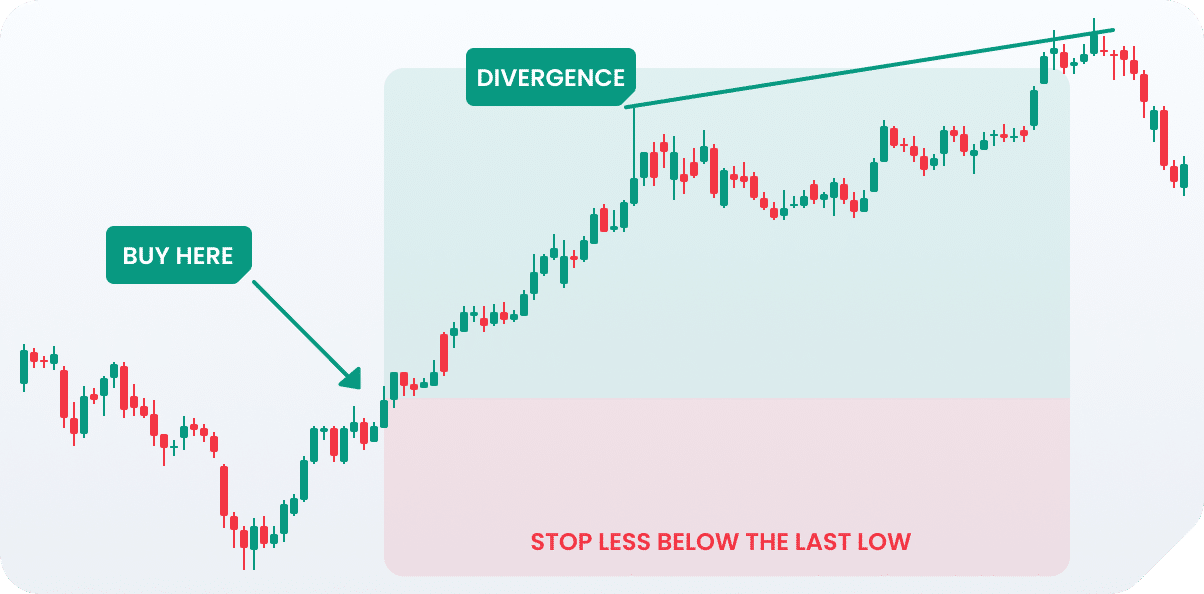

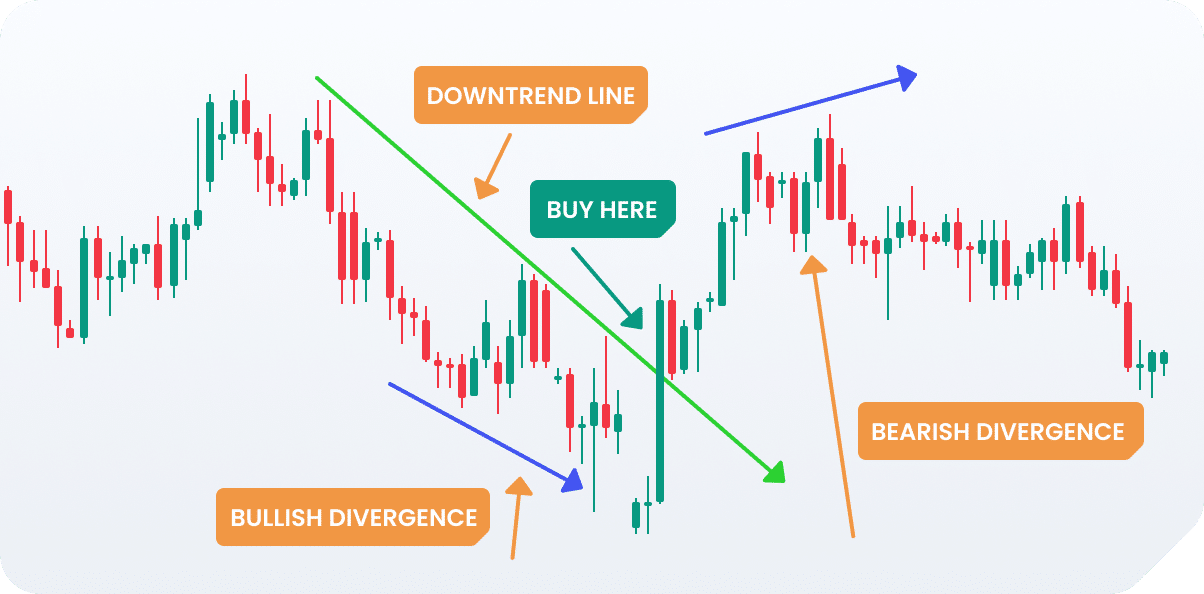

We are thrilled to introduce our advanced crypto AI trading bot! Our bot, created to improve your trading experience, uses artificial intelligence to find profitable chances in the crypto market, suggest strategies, and much more. It examines numerous cryptocurrency pairs using sophisticated algorithms to look for price convergence and divergence instances.

There are some critical challenges to trading crypto. For one, the markets are open 24/7, so traders must constantly monitor the charts if they want to take advantage of a trade. Hence, trading bots has become a game-changer for traders seeking to maximize their profits while minimizing their time and effort. It is an excellent option for those seeking crypto trading since it enables non-professional traders to leverage profitable strategies.

While we can’t cover everything within the scope of a blog article, we will mention some exciting points within the history of algorithmic trading, which, incidentally, precedes AI-driven trading, features that set us apart, and a short tutorial video. We will then look at flexible trading parameters (i.e., how they work, strategies, and results) before wrapping things up with some final thoughts or tutorial videos.

AI Driven Trading

It is no secret that navigating a bear market in trading can be challenging due to declining asset prices and heightened uncertainty. Emotions often drive impulsive decisions, leading to losses. To navigate these losses, an AI-driven testing of trading strategies would help by providing a more rational, data-driven approach. It evaluates strategies under bearish conditions, aiding traders in fine-tuning their approaches and identifying historically effective strategies, adding objectivity and confidence to their trading decisions. These are some of the many reasons that fueled the development of the Openfabric AI Trading Bot. Now, let’s look at the unique features that sets us apart from what is already in the market in the next paragraph.

Features That Set Us Apart

- Backtesting: One of the most critical aspects of successful trading is having a solid strategy in place. With our trading bot, you can backtest your strategies against historical market data. This feature allows you to evaluate the performance of your trading strategies before risking any real capital. Backtesting helps you refine your strategies and make data-driven decisions, ultimately increasing your chances of success in the volatile cryptocurrency market.

- Testnet Support: We understand the importance of risk management and learning without financial consequences. Our trading bot supports testnet trading, which means you can practice and refine your strategies in a simulated environment without risking your hard-earned money. This feature is particularly valuable for traders who are new to cryptocurrency trading or want to experiment with new strategies.

- Supported Coins: Our trading bot supports a wide range of popular cryptocurrencies, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Binance USD (BUSD)

- Litecoin (LTC)

- Tron (TRX)

- Ripple (XRP)

Flexible Trading Parameters

Our trading bot offers you the flexibility to customize various trading parameters, including:

Trading Amount: You can specify how much money you want to allocate for each trade, allowing you to manage your risk according to your preferences.

Time Intervals: We offer a range of time intervals, allowing you to trade on different timeframes, from second, minutes to days. This flexibility enables you to adapt your trading strategies to various market conditions.

Advanced Trading Strategies

Our trading bot supports a wide array of advanced trading strategies, including but not limited to:

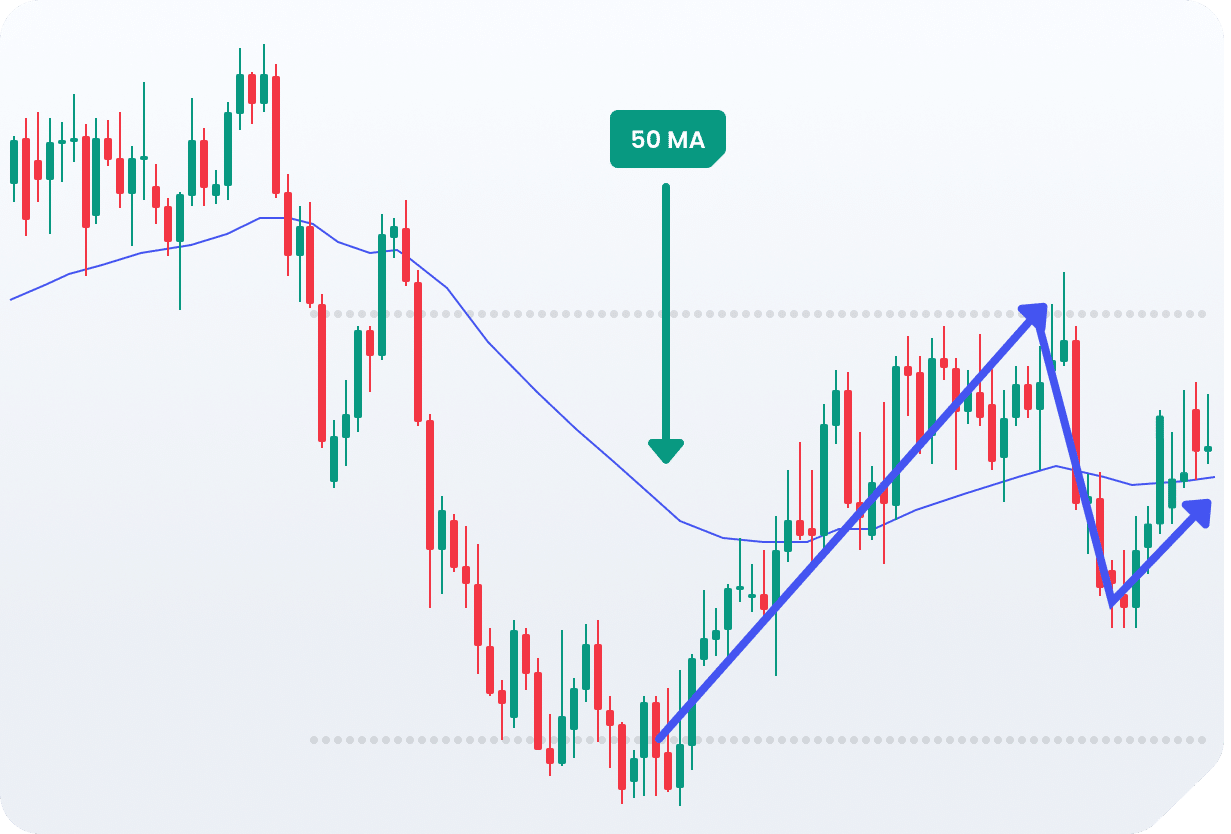

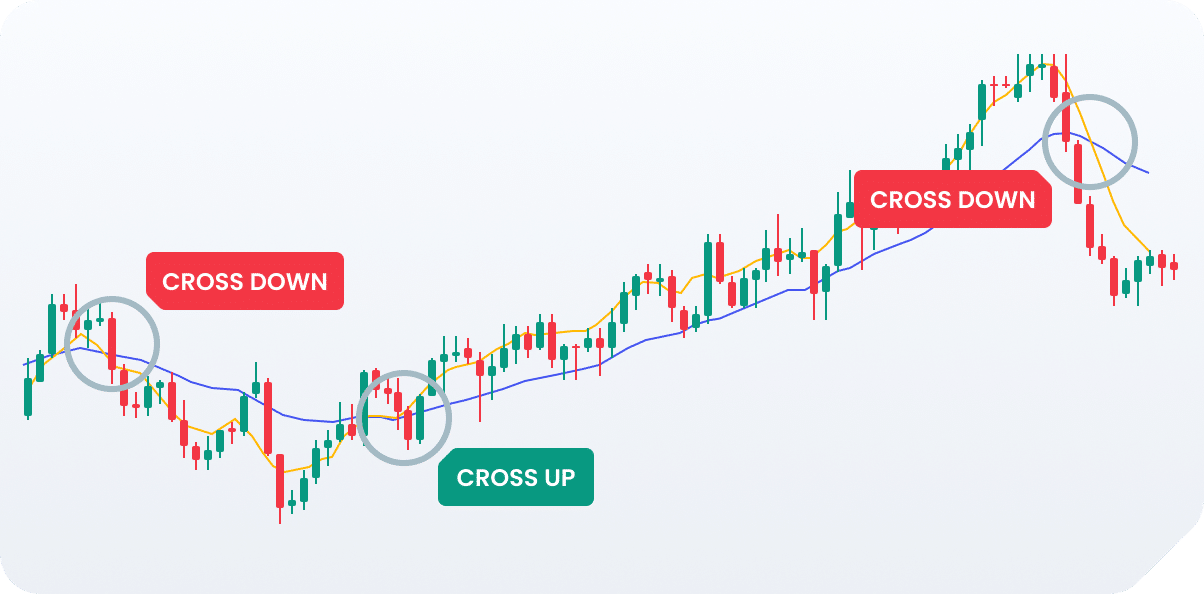

- Exponential Moving Average (EMA): EMA is a trend-following indicator that gives more weight to recent price data, helping traders identify current trends.

- Double Exponential Moving Average (Double-EMA): Double-EMA further reduces lag in moving averages by applying two EMAs to price data, aiding in trend analysis.

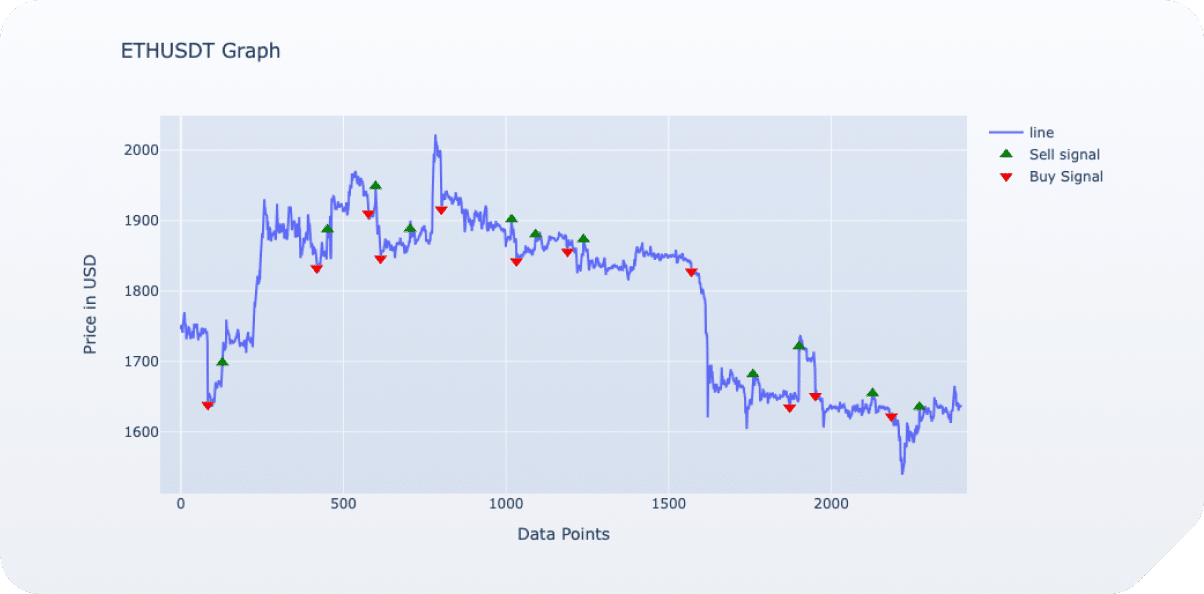

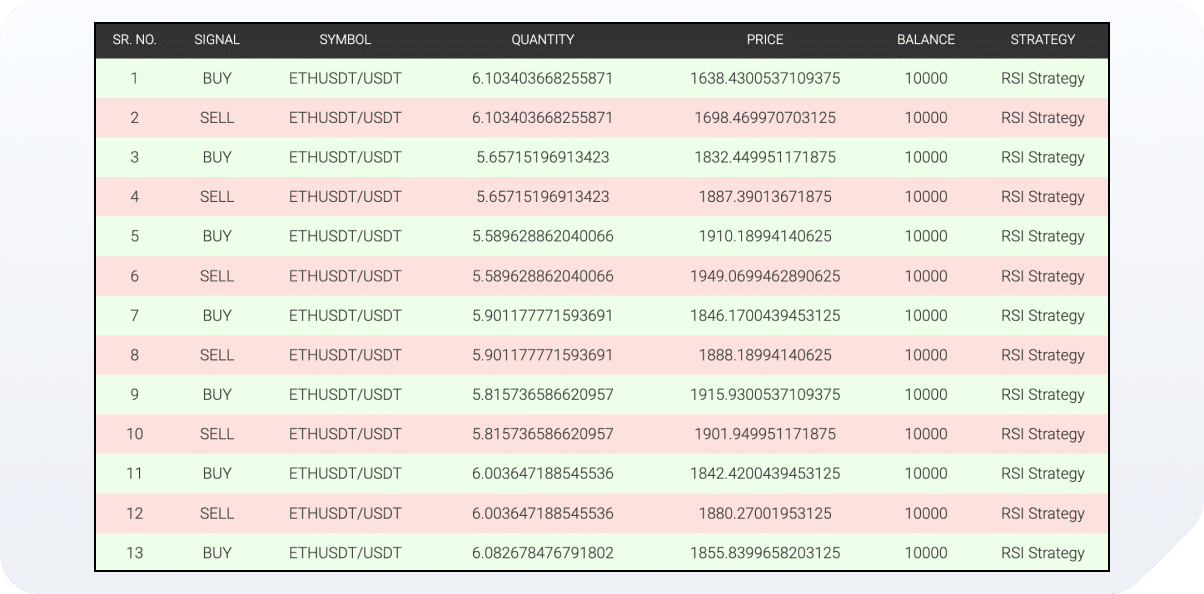

- Relative Strength Index (RSI): RSI is a momentum oscillator that measures price speed and change, indicating potential overbought or oversold conditions.

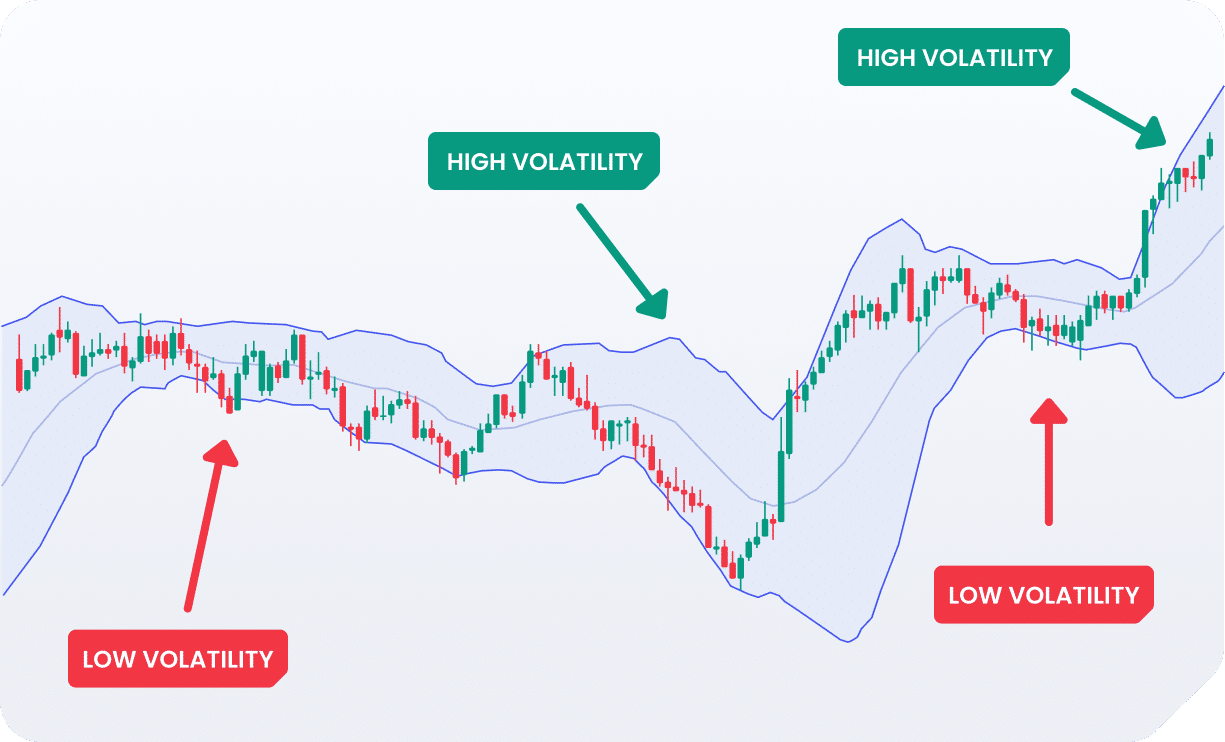

- Bollinger Bands (BBands): BBands consist of a middle SMA and outer bands representing standard deviations, used to gauge volatility and potential reversal points.

- Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that helps traders identify potential buy and sell signals.

- Stochastic Oscillator: The Stochastic Oscillator measures the location of the current price relative to its price range, signaling potential reversals and overbought/oversold conditions.

Moreover, you have the freedom to fine-tune the parameters for each strategy to align with your specific trading goals and risk tolerance. This level of customization empowers you to craft strategies tailored to your unique trading style.

Example Outputs:

Multi-basket trading

Our approach enables users to execute trades across multiple coins simultaneously, streamlining the process. Instead of initiating a new bot for each individual coin, users can define a basket of coins they wish to evaluate the bot’s performance on. The bot will then execute its trading strategy across all the selected coins in parallel.

Thanks to this a whole new level of trading opens, as you can define your strategies differently for specific coins and observe their performance at the same time. Having a possibility to create a diverse basket of crypto assets is as exciting as reasonable from an investors point of view.

Conclusion

In the world of cryptocurrency trading, precision and timing are everything. Our trading bot application combines the power of backtesting, testnet support, and a wide range of customizable features to help you navigate the crypto markets with confidence. Whether you’re a beginner looking to get started or an experienced trader seeking an edge, our trading bot is designed to streamline your trading experience and enhance your trading success.

With support for multiple cryptocurrencies, multi-basket trading and a variety of advanced strategies, our trading bot is a versatile tool that can adapt to the ever-changing crypto landscape. Start harnessing the power of automation and data-driven decision-making with our innovative trading bot application today and take your crypto trading to the next level.